ARLINGTON – The Arlington School Board will hold a public workshop Nov. 2 to discuss a proposed $107.5 million construction bond issue that would go to voters in a Feb. 13 special election.

The workshop is scheduled for 4:30 p.m. Thursday in the district’s board room, 315 French Ave.

The board Monday reviewed sections of a resolution they would need to pass. Discussion also turned to school projects contained in the bond package.

The proposal is based on recommendations from a 27-member facilities advisory committee that spent over a year reviewing the shape that buildings are in and classroom space needs within the growing district.

The package includes replacing Post Middle School, substantial classroom and field improvements at Arlington High School, security and environmental control improvements at all schools, classroom audio upgrades at all elementary schools and other enhancements.

“Thursday will be key to understanding how we’re going to proceed,” said Brian Lewis, district executive director of operations.

Based on facility needs, payoff of the 2000 high school bond coming in 2020, and interest rates hovering near historic lows, Lewis said the timing couldn’t be better.

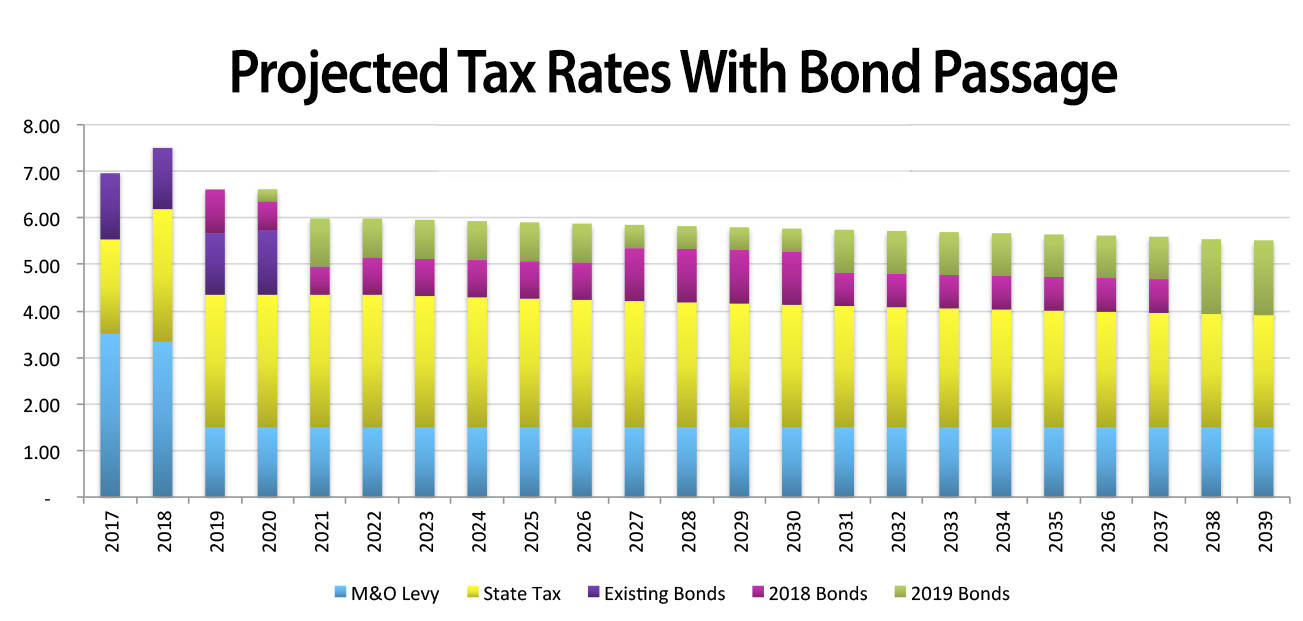

“There is an opportunity here to address these building needs without increasing taxes from the 2017 total tax rate,” Lewis said.

The tax rate between bonds and operation levies should drop from $4.93 per $1,000 of assessed valuation in 2017 to $3.76 per $1,000 in 2019 if the bond passes next year.

With the current tax rate, district homeowners are paying $1.42 per $1,000. With new bond passage, that total would go to $2.26 in 2019 and 2020, the overlap years between the two bonds – but would then drop to $1.64 and stay constant over the rest of the bond’s life.

Jon Gores, managing director at D.A. Davidson and Co., a Seattle brokerage firm, said the district is trying to structure the tax rate so it would actually be lower in 2019 than it is today, an opportunity made possible by changes in the state property tax and the district’s maintenance and operations levy converting into an enrichment levy. In the state Supreme Court’s McCleary decision, the education funding bill enacted by lawmakers this year renamed M&O levies enrichment levies, and have declared that the state now will fully cover all basic education costs.

Taking into account the total tax rate that includes the current M & O levy, bond and state property tax increase, homeowners now paying $6.96 per $1,000 assessed value would see that number rise to $7.50 next year, then drop to $6.61 in 2019, Gores said. Then, with existing bond debt paid, the tax rate would drop still further to $5.90 – less than taxpayers are now paying – over the bond’s life.

Gores said Arlington’s bond would be split into two separate sales – the first half in mid-2018 and the latter half in December 2019. Federal regulations require that fundingbe expended within a three-year window; the split buys more time. Design and permitting for Post would take about two years, with small projects getting done in 2019, Lewis said. The big year for projects including Post would be 2020, in hopes that the new middle school would open a year later.

The outlook on local property values is strong. Gores said average property values grew just under 7 percent this year, and are projected to increase 11 percent in 2018.

“You’re running higher than your five-year average and in eight years this is the most new construction you have had in one year, so we’re really starting to see some growth in the tax base,” Gores said.

Board member Ursula Ghirardo at an earlier meeting asked about state construction assistance funds. Lewis said the district doesn’t qualify for unhoused student assistance funds, but does for “new in lieu of modernizations.” Building a new Post Middle School would qualify the district for state dollars.

Board member Kay Duskin inquired about the state’s capital budget, where those dollars would come from. The budget hasn’t yet been approved, so she wondered what the impact would be on Arlington projects like Post when there isn’t enough money to fund every districts’ projects.

Lewis said, “We chose not to include state assistance as a resource to build the projects that are in this package.”

The bond measure would require a 60 percent “yes” vote.