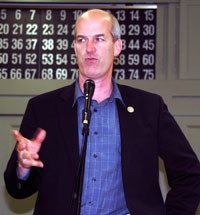

SMOKEY POINT — U.S. Rep. Rick Larsen wanted his senior constituents to know that he hears their concerns about health care.

“I care because you care,” Larsen told his audience at the Stillaguamish Senior Center on May 16. “These are issues you want to have addressed.”

Larsen fielded questions from an audience that was already receptive to his message of protecting health care for seniors, as he joined representatives of the AARP in discussing the potential impact of federal budget cuts on Medicare.

“The Affordable Care Act that was passed under President Obama is one step on the road to closing the donut hole,” Larsen said, referring to the gap in health care coverage that many seniors suffer from. He likewise touted the legislation as strengthening the Medicare Trust Fund and facilitating increased use of preventive health care, the latter of which he deemed a long-term money-saver by keeping people healthier longer, so that they won’t need as much medical care when they get older.

“According to the nonpartisan Congressional Budget Office, this plan will reduce the deficit by $230 billion in 10 years,” Larsen said. “And the first thing the new Republican majority did in the House of Representatives was vote to repeal health care reform.”

Larsen drew laughter as he promised not to badmouth fellow U.S. Rep. Paul Ryan of Wisconsin, but he criticized Ryan’s budget proposal for seeking to turn Medicare into a voucher system.

“You can call it Medicare, but it will be nothing like Medicare, which is a guaranteed benefit, that you pay into until the age of 65 and you will get paid back,” Larsen said. “Again, the nonpartisan Congressional Budget Office says this will double seniors’ out-of-pocket health care payments. You’d have to save up $182,000 more just to be able to afford the same care as you would get under regular Medicare.”

Larsen cited Social Security as a key component of many seniors’ retirement security, and pledged that he would vote to raise the tax cap on Social Security, which was met with applause.

“The way it works now is, you’re taxed for Social Security on your salary for up to about $106,000,” Larsen said. “Any dollars you make over and above that $106,000, you don’t have to pay any Social Security tax on. I make more than that, and I’m willing to pay. I always look at those extra dollars and ask myself why I’m paying zero after that cap. I can afford it, and it would benefit the country as a whole by making retirement more stable.”nts that their Cost of Living Adjustments have not increased in the past two years, even though their expenses have.

“The reason is because COLA is tied to the Consumer Price Index, which doesn’t accurately reflect your own living circumstances,” Larsen said. “The CPI is irrelevant to seniors.”

With a number of the reforms that Larsen supports he reported that he’s encountered push-back from private insurance companies, whom he likened to oil and gas companies.

“Oil and gas companies don’t need $16 billion of your money to go drill,” Larsen said. “They’re perfectly capable of funding that with the record profits they’re earning. I keep having to assure these companies that the world will not end if their subsidies disappear.”